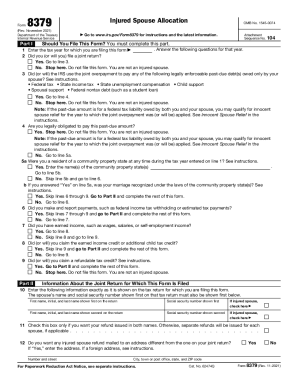

IRS 8379 2023-2025 free printable template

Show details

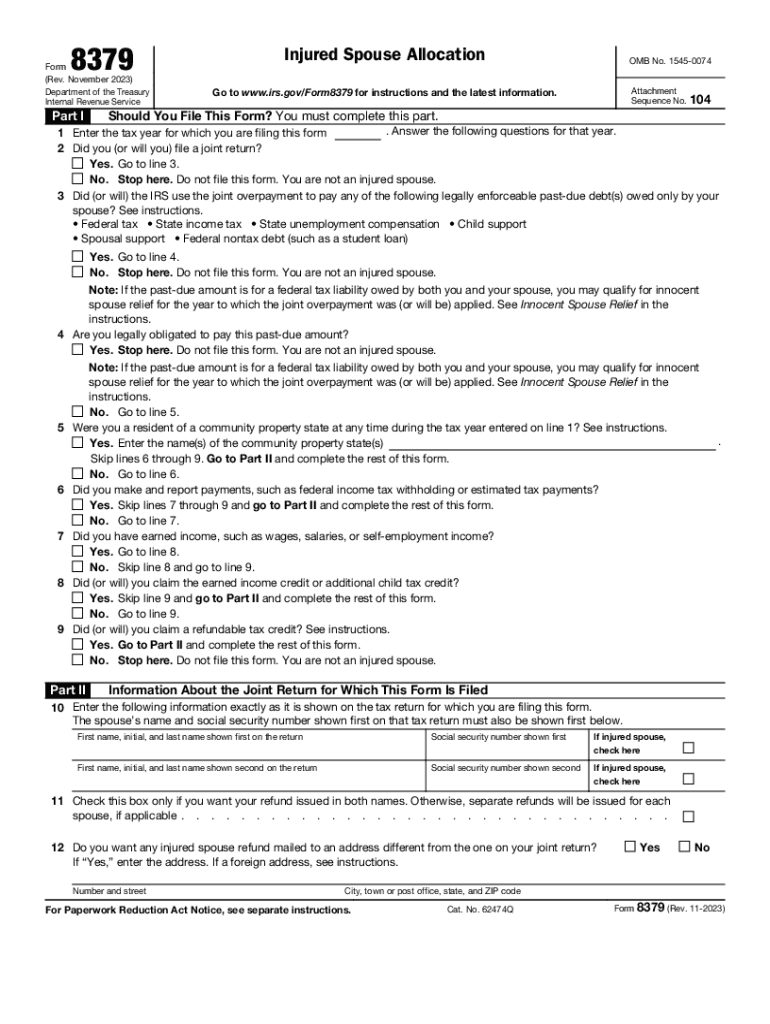

Cat. No. 62474Q Form 8379 Rev. 11-2023 Page 2 Allocation Between Spouses of Items on the Joint Return. See the separate Form 8379 instructions for Part III. Complete this part only if you are filing Form 8379 by itself and not with your tax return. Under penalties of perjury I declare that I have examined this form and any accompanying schedules or statements and to the best of my knowledge and belief they are true correct and complete. 4 Are you legally obligated to pay this past-due amount...

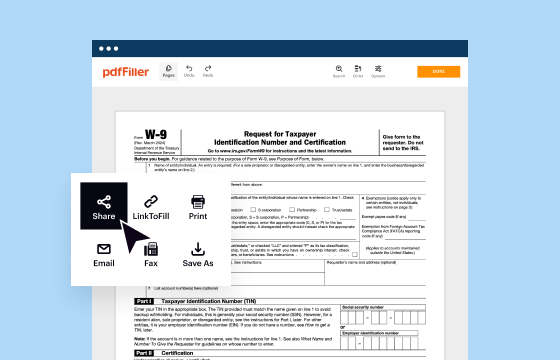

pdfFiller is not affiliated with IRS

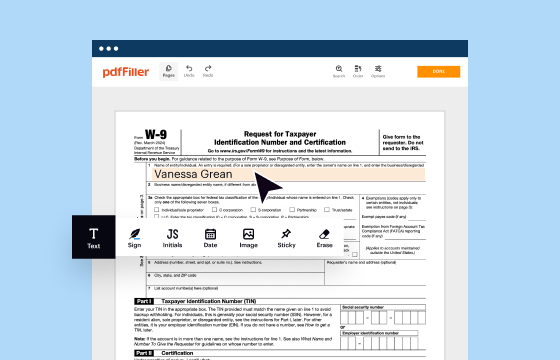

Understanding and Utilizing IRS Form 8379

Detailed Steps for Editing IRS 8379

How to Complete IRS Form 8379

Understanding and Utilizing IRS Form 8379

IRS Form 8379, the "Injured Spouse Allocation," is essential for taxpayers who need to protect their tax refunds from being seized to pay a past due debt. This guide provides critical information about the form, its purpose, and instructions for successful filing.

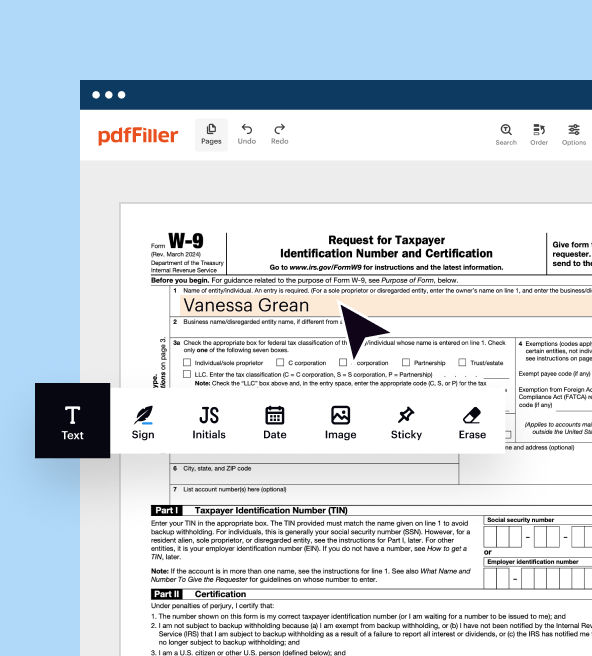

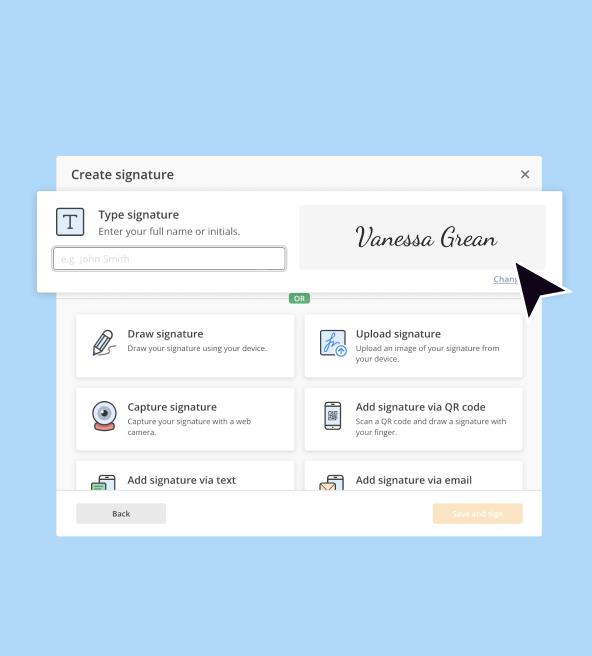

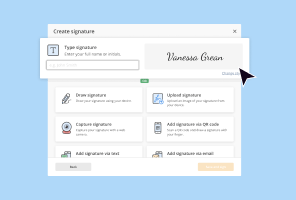

Detailed Steps for Editing IRS 8379

Editing IRS Form 8379 requires accuracy to ensure timely processing. Follow these steps to edit the form correctly:

01

Gather your tax documents and past due debts to reference while filling out the form.

02

Open your existing IRS 8379, using PDF or word processing software to ensure the form is editable.

03

Identify areas that need correction; ensure all information aligns with current financial records.

04

Update your personal information, such as name, Social Security number, and filing status, if necessary.

05

Review your calculations, specifically the refund allocation calculations, to maintain accuracy.

06

Utilize a reliable validation tool, if available, to check for common errors before submission.

How to Complete IRS Form 8379

Following these precise instructions will ensure correct completion of Form 8379:

01

Begin with your filing status and personal details in Part 1, such as your name and Social Security number.

02

In Part 2, specify the year of the tax return you’re addressing.

03

Complete Part 3 by detailing your income, listing both spouses' wages, and any other income earned.

04

Panel 4 addresses your debts; provide a brief description of relevant debts that could affect your refund.

05

In Part 5, allocate the tax refund; make calculations based on the entered income and debts.

06

Sign and date the form, ensuring both spouses have signed to validate the submission.

Show more

Show less

Recent Updates and Changes to IRS Form 8379

Recent Updates and Changes to IRS Form 8379

Form 8379 saw several important updates in recent years that are crucial to recognize for accurate filing. Tax year collaborations with improved digital avenues for tracking and submitting forms have been introduced, emphasizing online submission methods to enhance processing times.

Key Insights on IRS Form 8379

What Exactly is IRS Form 8379?

Why is IRS Form 8379 Important?

Who Needs to File Form 8379?

When Can Exemptions Apply to IRS Form 8379?

Breaking Down the Components of IRS Form 8379

Filing Deadlines for IRS Form 8379

Comparing IRS Form 8379 with Similar Forms

Transactions Relevant to IRS Form 8379

Number of Copies Required for Submission

Consequences of Failing to Submit IRS Form 8379

Information Needed for Filing IRS Form 8379

Additional Forms That May Accompany IRS Form 8379

Where to Submit IRS Form 8379

Key Insights on IRS Form 8379

What Exactly is IRS Form 8379?

IRS Form 8379 is designed for "injured" spouses, allowing them to claim their share of the tax refund when their spouse owes certain debts. It provides a protective measure ensuring that tax refunds are fairly allocated based on the income of each spouse.

Why is IRS Form 8379 Important?

The purpose of IRS Form 8379 is twofold: it provides spouses an avenue to claim their rightful tax refunds while protecting their financial interests from the other spouse's past due debts. This form ensures transparency in tax allocation during joint filings.

Who Needs to File Form 8379?

Taxpayers should complete Form 8379 if their refund is subject to offset due to their spouse’s debts, such as child support or federal student loans. Common scenarios include:

01

Filing jointly with a spouse who owes back taxes.

02

Claiming tax refunds while your partner is behind on court-ordered payments.

03

Addressing federal offsets due to student loan defaults affecting joint refunds.

When Can Exemptions Apply to IRS Form 8379?

Exemptions to filing Form 8379 might apply under conditions such as:

01

Income thresholds; if your income is below a certain limit, you may not need to file.

02

Specific debt types that don’t involve joint obligations.

03

Separation or divorce scenarios where debts were allocated pre-filing.

Breaking Down the Components of IRS Form 8379

Form 8379 comprises several sections including personal information, income sources, debt specifics, and refund allocation. Each component is crucial for deciphering how to appropriately distribute joint refunds and protects the injured spouse's finances.

Filing Deadlines for IRS Form 8379

IRS Form 8379 must be submitted along with your tax return, typically by April 15 of the filing year. Extensions may apply based on individual tax circumstances, but timeliness must be maintained to prevent any potential offsets.

Comparing IRS Form 8379 with Similar Forms

Unlike Form 8379, which specifically addresses refunds affected by debts, Form 8857 ("Request for Innocent Spouse Relief") focuses on relief from joint liability. Additionally, Form 8862 assists with claiming the Earned Income Tax Credit after a disallowance.

Transactions Relevant to IRS Form 8379

While Form 8379 primarily addresses tax allocations for joint filers, it is relevant in cases of federal offsets and must be utilized appropriately in these instances for tax refunds to be disbursed correctly.

Number of Copies Required for Submission

Typically, one completed copy of Form 8379 is required for IRS submission alongside your primary tax return. However, make copies for your records, particularly if filing by mail.

Consequences of Failing to Submit IRS Form 8379

Failure to submit Form 8379 can lead to numerous repercussions, including:

01

A loss of rightful tax refunds that may offset other debts.

02

Financial penalties associated with under-reporting income.

03

Potential legal ramifications concerning tax liabilities if funds are offset without proper allocation.

Information Needed for Filing IRS Form 8379

To successfully file Form 8379, gather the following:

01

Both spouses' Social Security numbers and filing status.

02

Total income recorded from all sources during the fiscal year.

03

Details of past due debts that might impact tax refunds.

Additional Forms That May Accompany IRS Form 8379

In some cases, such as when seeking adjustment for certain deductions, you may need to submit additional forms like Form 1040 or Form 8862 concurrently with Form 8379.

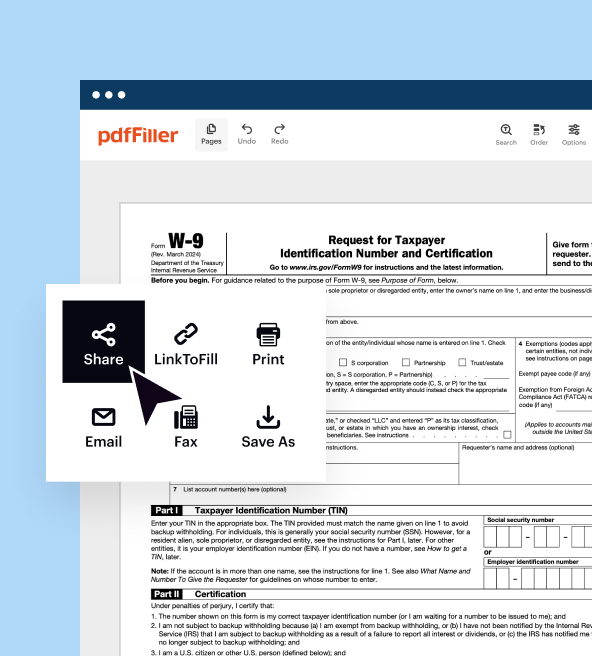

Where to Submit IRS Form 8379

Submit Form 8379 along with your tax return to the relevant IRS address based on your location. For electronic filing, use an authorized e-filing provider, ensuring that Form 8379 is included in your submission package.

Understanding and properly filing IRS Form 8379 is crucial for protecting your tax refund rights. If you have further questions or need assistance, consider reaching out to a tax professional or utilizing resources such as pdfFiller to streamline your filing process.

Show more

Show less

Try Risk Free

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.